KPMG 2023 auto poll shows a bumpy road to zero-emission vehicles in Canada

by CM staff

Six in 10 Canadians plan to buy a new vehicle within the next five years and want a greener alternative to gas if they can actually get one, a KPMG survey shows.

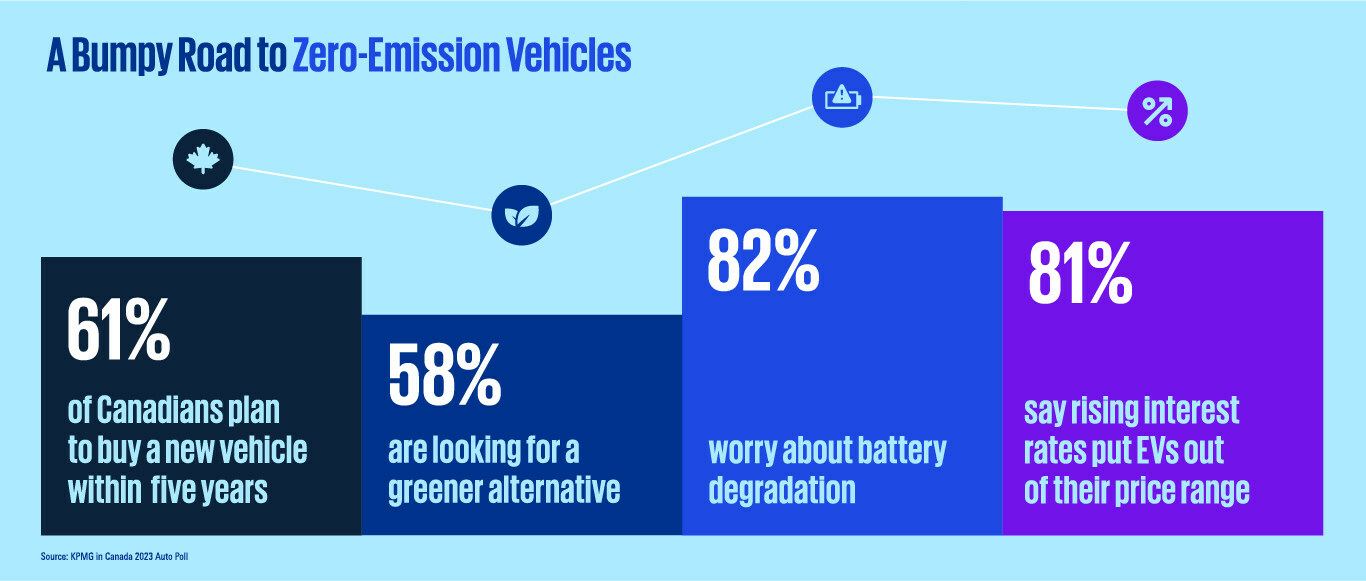

KPMG in Canada 2023 Auto poll infographic: A bumpy road to zero-emmision vehicles. (CNW Group/KPMG LLP)

TORONTO — As many as six in 10 Canadians will buy a new vehicle within the next five years and would prefer a greener alternative to carbon-emitting gasoline-powered vehicles. But most will end up settling for a gas-powered one instead of electric due to higher financing costs, delays in delivery, and concerns over battery range and charging reliability, finds new KPMG in Canada poll research.

“It’s not that EVs have lost their appeal but rather that lack of inventory and long waiting lists over the past couple of years are giving consumers reasons to pause,” said Damiano Peluso, Partner and National Automotive Industry Leader, KPMG in Canada. “And now with expectations of a recession and sharply higher financing rates, our poll research shows consumer sentiment has shifted to pragmatism over ‘the machine of a dream’. As more EV models come to market this year and next, we will see sales pick up but a lot hinges on the price point and how well these persistent concerns about range and charging infrastructure can be addressed.”

Findings in the report show that 61 per cent of Canadians plan to buy a new vehicle within the next five years, of whom 42 per cent will buy within the next two years, or by 2025. More men (67 per cent) than women (56 per cent) will look to buy a new vehicle within the next five years. More than two thirds (67 per cent) planning to buy within the next five years want to spend less than $50,000 on a new vehicle: 42 per cent, in the $30,000 to $49,999 price range, and 25 per cent, less than $30,000. Twenty-one per cent say they are willing to spend $50,000 to $74,999 on a new vehicle. The remaining 12 per cent are willing to spend more than $75,000.

While 58 per cent who plan to buy a new vehicle by 2033 say they want a greener vehicle: hybrid (30 per cent), a battery EV (15 per cent), and a plug-in EV (13 per cent). The remaining 42 per cent prefer a gas-powered internal combustion engine (ICE) powertrain.

The primary factors preventing Canadians from buying an EV were:

- 33 per cent say their EV hesitancy relates to many factors combined: the cost of an EV, charger anxiety, including the lack and reliability of charging stations, limited EV availability and long-wait times, and skepticism over battery technology,

- Over a quarter (26 per cent) say EVs are too expensive,

- 14 per cent cite charger anxiety and lack of infrastructure,

- 8 per cent say limited EV availability and long-wait times are preventing them from buying an EV,

- 7 per cent say the primary reason is that they don’t trust battery technology.

Automakers may need to rethink their footprints and supply chains. Canadians are price sensitive, and while they crave range, they also say the only way to make EVs accessible to everyone is to go small, the KPMG poll shows. Yet only 55 per cent would buy a small EV (with limited range) if the country had a ubiquitous fast-charging infrastructure and 80 per cent say they won’t consider an EV without a 400-kilometre range.

There is also opportunity for automakers and auto dealers to pick up market share. Almost half of market is open to change, the poll shows. Only 54 per cent of respondents intend to buy a ZEV that’s the same brand as their current make. With many new EV models set to debut this year, the top three brands that prospective Canadian EV buyers say they’re most likely to purchase now are: Toyota, Honda, and, dropping from top spot last year to third, Tesla.

Over two-thirds (67 per cent) would prefer to buy an EV assembled in North America and half (51 per cent) are concerned the transition to EV manufacturing will result in more job losses in the Canadian auto industry. According to KPMG International’s 23rd Annual Global Automotive Executive Survey, over 910 executives around the world have tempered worldwide EV sales forecasts and are concerned about supplies of commodities and components. They also believe consumer buying decisions in the next five years will focus on the importance of driving performance and brand image.

“While our survey shows that most Canadians want to buy an EV that’s made in North America, important decisions are still being made on battery, assembly, and parts manufacturing locations,” said Tammy Brown, Partner and National Leader, Industrial Markets, KPMG in Canada. “As a result, the domestic market may not be able to meet the federal zero-emission vehicle targets, which may force Canadians to buy a greater share of imported electric vehicles.”

“The global auto industry took nearly 13 decades to perfect the internal combustion engine and are now trying to meet consumer and regulatory expectations for electric vehicles in just two decades,” said Brown. “We’re optimistic it can be done, with Canada playing a key role given our robust auto manufacturing and innovation ecosystem and proximity to key U.S. markets. The challenge is, it’s an entirely new industry dependent on commodities that have yet to be mined in Canada and components that can, as we’ve seen, become scarce.”