KPMG poll shows supply chain bottlenecks in Canada

by CM Staff

Consumer demand will peak over the next few weeks with the advent of the holiday season, and many shoppers will find likely empty shelves, "out of stock" notifications online.

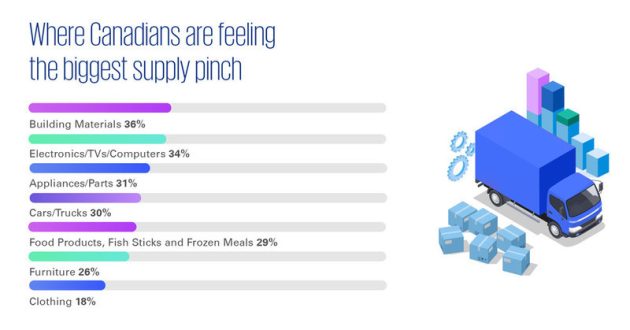

Where Canadians are feeling the biggest supply pinch (CNW Group/KPMG LLP)

TORONTO — This year’s holiday wish list could look a bit different for Canadians, as the hope of giving and receiving the latest gadget or toy is replaced by the hope that they are even available, according to a new poll on supply chain bottlenecks by KPMG in Canada.

In a survey conducted last week, nearly three in five Canadians who have started their holiday shopping say they have not been able to find what they want, and more than half (57 per cent) planning to give gifts this year have not even started their shopping, making it unlikely they’ll find what they want either online or on store shelves in time for the holidays.

Key Poll Highlights:

- Nearly three in five (58 per cent) Canadians who have started their holiday shopping have not been able to find what they want

- 57 per cent planning to give gifts this year have not yet started their shopping because they’re waiting for Black Friday/Cyber Monday sales, or they typically wait until the last minute

- 67 per cent believe if they don’t order items by mid-November, they doubt they will arrive in time for the holidays

- 51 per cent say they likely missed the last day they can place orders and expect container ships bringing them in from overseas to arrive in time for the holiday season

- Well over half (56 per cent) say they’re “living in weekly hope” that the gifts they ordered will actually arrive in time for the holidays

- 73 per cent say they “feel lucky” that they got the item they wanted while it was in stock

- 73 per cent are buying products made in Canada instead of overseas

- 55 per cent say they are “stocking up on the basics”

- 87 per cent expect companies to provide real-time online information on product supplies, estimated delivery dates and times and also be flexible on returns

Consumer demand will peak over the next few weeks with the advent of the holiday season, and many shoppers will find likely empty shelves, “out of stock” notifications online, and delivery dates that miss the holiday window and stretch well into 2022, says Mr. Thirion.

According to online freight shipping marketplace and platform Freightos, it takes an estimated 24-36 days to ship a 40-foot shipping container from Shenzen, China to Prince Rupert, Montreal, or Halifax, with “door-to-door” shipping times nearly twice as long. Some ports are operating 24 hours a day to process container traffic faster.

Brand loyalty hit by clogged supply chains

When it comes to consumer expectations about product availability, Canadians have high standards, and brands that don’t meet the bar could see customer loyalty suffer. Seventy-eight per cent say they will switch brands if they can’t get what they want when they want it. For consumers who tend to be more loyal to specific brands, 56 per cent said they will stick to their brand even if they have to wait to get their products, while 84 per cent said they are willing to explore other options if their favourite brand can’t deliver their products on time.

Inflation hitting Canadians

The global traffic jam of container ships is pushing up consumer prices globally and at home. Canada’s annual inflation rate rose 4.4 per cent in September, the fastest pace since 2003, and higher prices are a major factor for consumer loyalty, KPMG’s survey shows. More than half (54 per cent) reject the idea of paying more to get the brands they want, and 79 per cent said they will switch brands if they raise prices.

While the Bank of Canada expects inflation to persist into next year before easing back to its two per cent target by late 2022, nearly three-quarters of Canadians (74 per cent) don’t expect prices to return to pre-COVID levels, even when supply bottlenecks and the disruption of supply chains clears up. Prolonged higher prices could take a toll on consumer loyalty, with nearly 77 per cent saying they’ll have to think twice about brand loyalty if prices don’t return to pre-COVID levels.

KPMG’s latest poll, conducted in November with a sample size of 1,002 Canadians, is the third consecutive survey that highlights the growing economic risks of supply chain snags.