Innovative OEM strategies to spark commercial vehicle aftersales market in Europe

by CM Staff

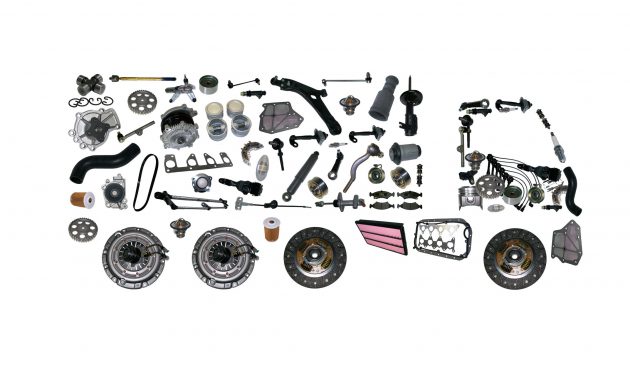

Remanufacturing of replacement parts and multi-brand servicing create additional revenue streams for OEMs, finds Frost & Sullivan.

cv_aftersales

SANTA CLARA — Frost & Sullivan’s recent analysis of the Commercial Vehicle Aftermarket in Europe finds that strategies such as aftersales digitalization, white labeling (product produced by one company rebranded by other companies) for genuine parts/services, and multi-brand servicing are instrumental for original equipment manufacturers (OEMs) to drive the commercial vehicle (CV) aftersales market in Europe. Despite the OEM initiatives, aftersales market growth is expected to be slow due to low vehicle-in-operation (VIO) growth in 2020 and the sluggish recovery of vehicle registrations during the COVID-19 pandemic. The market is estimated to reach €16.79 billion by 2027 from €13.73 billion in 2021. The study focuses on the potential trends that will disrupt the aftermarket, the effect of disruptive trends on OEMs, and more.

“An increase in the number of older trucks on the road provides OEMs with an opportunity to come up with competitively priced value-line products for fleet operators that deal with older trucks,” said Jagadesh Chandran, Industry Principal, Mobility Practice at Frost & Sullivan. “In the future, the emergence of electric and autonomous trucks is expected to expedite the need for new products, which will increase the demand for genuine parts from OEMs.”

Chandran added: “Remanufacturing of replacement parts and multi-brand servicing will create additional revenue streams for OEMs, thereby addressing the needs of the price-sensitive customer segment that deals with relatively older vehicles. Further, predictive maintenance will become a necessity as time-based maintenance will lose significance. Due to this, OEMs’ data-enabled platforms and revenue streams will result in sophisticated services like predictive analytics and prognostics.”

Market participants should focus on the following growth prospects:

- Multi-brand Servicing: OEMs should consider extending repair and maintenance services beyond authorized dealerships. These strategic initiatives will help OEMs expand to several locations and reach more fleet operators, enabling them to offer effective and timely service with increased revenue opportunities.

- 3D Printing and Remanufacturing: Apart from using metal parts, OEMs should also start exploring 3D-printed technology to reproduce plastic parts to expand the breadth of their spare parts offerings.

- Data Analytics for Predictive Fleet Maintenance: OEMs should form strategic partnerships with third-party predictive analytics service providers that analyze the data generated from telematics devices fitted onthe trucks.

Benchmarking of OEM Strategies for the Commercial Vehicle Aftermarket in Europe is part of Frost & Sullivan’s Global Mobility Growth Partnership Service program.